In the world of personal finance and investing, diversification is often described as the golden rule. It’s the practice of spreading your money across different asset classes to reduce risk and improve potential returns. Among the various investment options available, property (real estate) and stocks are two of the most popular and powerful wealth-building tools.

However, each of these asset classes behaves differently, and knowing how to balance them strategically can be the key to long-term financial success. In this article, we will explore smart ways to diversify between property and stocks, helping you make informed decisions for a stable and profitable portfolio.

1. Understanding Property vs. Stocks

Before diving into diversification strategies, it’s important to understand how both investments differ:

- Property (Real Estate): Involves investing in physical assets like residential, commercial, or rental properties. Real estate provides stability, rental income, and capital appreciation over time. It’s a tangible asset that often performs well during inflationary periods.

- Stocks (Equity Investments): Represent ownership in a company. Stocks can offer high returns through dividends and capital gains, but they also come with higher volatility and short-term risk. They are highly liquid compared to real estate.

A well-balanced investor recognizes the strengths and weaknesses of both, using them together to create a resilient financial portfolio.

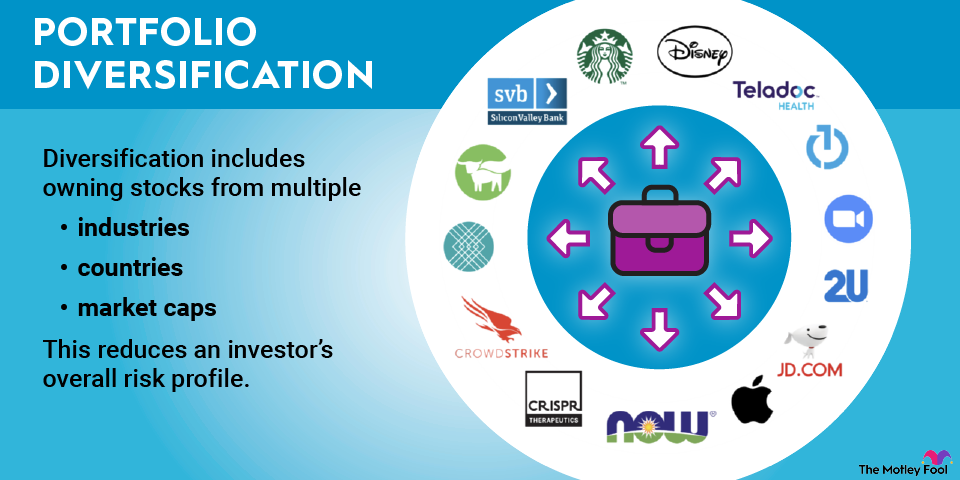

2. The Importance of Diversification

Diversification doesn’t just mean owning different assets—it’s about owning the right mix that reduces overall portfolio risk.

For example, when stock markets are volatile or underperforming, real estate often remains steady. Conversely, during real estate slumps, stocks may provide better liquidity and quicker gains. By combining the two, investors can cushion the impact of market fluctuations and ensure more consistent returns.

3. Assess Your Financial Goals and Risk Appetite

The first step in diversifying between property and stocks is understanding your financial goals and risk tolerance.

Ask yourself:

- Are you looking for long-term capital growth or short-term liquidity?

- How comfortable are you with market volatility?

- Do you need regular income (rent or dividends), or are you focused on asset appreciation?

For instance, if you’re a conservative investor who values stability and regular income, real estate might take a larger share of your portfolio. On the other hand, if you’re younger and can handle higher volatility for potentially higher returns, you might allocate more to stocks.

4. Follow the 60-40 Rule (or Adjust It)

A classic diversification strategy is the 60-40 rule — where 60% of your investments go into equities (stocks, mutual funds, ETFs) and 40% into real estate or other tangible assets.

However, this ratio is not fixed. It can be adjusted based on your age, goals, and market conditions:

- Young investors (below 35): 70% stocks, 30% property

- Mid-age investors (35-50): 60% stocks, 40% property

- Retirees or conservative investors: 40% stocks, 60% property

The key is to review and rebalance your portfolio regularly to keep it aligned with your goals.

5. Use Real Estate for Stability, Stocks for Growth

Real estate is often considered a defensive asset, meaning it provides stability and predictable income even in uncertain economic times. Property investments generate rental income and appreciate steadily over time.

Stocks, on the other hand, are growth assets. Over the long run, they have historically outperformed most other asset classes. Investing in equity mutual funds, index funds, or blue-chip stocks can significantly boost your portfolio’s returns.

A smart strategy is to let your real estate holdings offer security while using stocks to power your wealth growth.

6. Invest Indirectly Through REITs and Real Estate Funds

If buying a property outright seems too expensive or complicated, Real Estate Investment Trusts (REITs) offer an excellent alternative.

REITs are investment vehicles that allow you to invest in real estate projects (like offices, malls, or warehouses) without owning property directly. They trade on stock exchanges like shares, offering both liquidity and diversification benefits.

By including REITs in your portfolio, you get exposure to the real estate market’s stability along with the flexibility of stock trading.

7. Diversify Within Each Asset Class

True diversification doesn’t stop at owning just one property or a few stocks. You need to diversify within each asset type:

- Within Real Estate: Spread investments across residential, commercial, and rental properties. You can also diversify geographically—owning property in different cities or regions reduces local market risks.

- Within Stocks: Invest across sectors (technology, healthcare, finance, etc.) and market caps (large-cap, mid-cap, small-cap). Consider mutual funds or index funds for easy diversification.

This multi-layered approach ensures that poor performance in one sector or region doesn’t drag down your entire portfolio.

8. Monitor Market Cycles

Both real estate and stock markets move in cycles. Understanding these cycles helps you make better timing decisions.

For example, when property prices are high and yields are falling, you might shift more funds toward undervalued stocks. Similarly, if the stock market is overvalued and real estate prices are low, investing in property could be wiser.

Staying aware of market trends, interest rates, and economic indicators allows you to rebalance effectively and capture growth opportunities.

9. Consider Tax Efficiency

Taxation plays a major role in determining your net returns. Each asset class has unique tax implications:

- Real Estate: Rental income is taxable, but you can claim deductions on property taxes, maintenance, and home loan interest. Long-term capital gains from property sales (after 24 months) are taxed at 20% with indexation benefits.

- Stocks: Long-term capital gains (after 12 months) are taxed at 10% above ₹1 lakh annually, while short-term gains are taxed at 15%.

A balanced portfolio should consider after-tax returns to ensure maximum efficiency.

10. Rebalance Regularly

Diversification isn’t a one-time task—it’s an ongoing process. As property values or stock prices change, your allocation may drift away from the intended balance.

For instance, if your stock portfolio grows faster than your property value, your equity exposure may increase beyond your comfort level. In such cases, you can rebalance by selling some stocks and reallocating the gains toward property or other assets.

Rebalancing once or twice a year helps maintain your desired risk-return ratio.

Conclusion

Building wealth through a balanced mix of property and stocks is one of the smartest strategies for long-term financial security. Real estate offers tangible stability and steady income, while stocks provide growth and liquidity. When these two are managed together thoughtfully, they complement each other perfectly.

The key lies in understanding your goals, diversifying wisely within and across asset classes, monitoring market cycles, and rebalancing regularly. By following these smart ways to diversify between property and stocks, you can enjoy the best of both worlds—steady cash flow and long-term capital appreciation—ensuring a strong and resilient financial future.